Need a quick and reliable way to assess commercial paper investments in Nigeria? The Nigeria Commercial Paper Calculator simplifies the process, providing instant and accurate results for investors and businesses.

A commercial paper (CP) is a short-term debt instrument issued by corporations and financial institutions to raise quick funds. In Nigeria, CPs serve as a key financial tool, offering businesses an alternative to bank loans while giving investors a profitable return on their investment.

With the free online Nigeria Commercial Paper Calculator, you can effortlessly compute discount yield, effective yield, and maturity value within seconds. Whether you’re an investor comparing CP options or a business issuing CPs, this tool ensures precise calculations, saving you time and effort.

What is a Commercial Paper in Nigeria?

A Commercial Paper (CP) is a short-term, unsecured financial instrument issued by corporations, banks, and financial institutions to raise funds for immediate business needs. It provides a quick and cost-effective way for companies to access capital without requiring collateral.

Who Issues Commercial Papers?

In Nigeria, CPs are typically issued by:

- ✔ Corporations – Large businesses issue CPs to finance working capital, operational costs, or short-term projects.

- ✔ Banks & Financial Institutions – These entities use CPs to manage liquidity and fund short-term lending activities.

- ✔ Government & Public Entities – In some cases, government-backed organizations may also issue CPs as part of their financial planning.

Maturity Period & Investor Returns

CPs usually have a maturity period between 15 days to 1 year, making them a preferred option for short-term investments. Instead of earning interest like traditional loans, CPs are sold at a lower price than their actual value (face value). When the CP reaches maturity, the investor receives the full face value, and the profit is the difference between the buying price and the maturity amount.

| Feature | Details |

|---|---|

| Maturity Period | 15 days to 1 year |

| Issuance Type | Sold at a discounted price |

| Investor Returns | Profit comes from the difference between purchase price and maturity valueProfit comes from the difference between purchase price and maturity value |

| Regulatory Body | Central Bank of Nigeria (CBN) |

Why Do Investors Choose Commercial Papers?

| Higher Returns | CPs often provide better returns than savings accounts or treasury bills. |

| Short-Term Liquidity | Investors can access their money quickly due to the short maturity period. |

| Diversification | CPs offer an alternative to traditional investments like stocks, bonds, or fixed deposits. |

| Lower Risk (for High-Rated Issuers) | CPs from reputable institutions with good credit ratings are considered relatively low-risk. |

Regulatory Framework (CBN Guidelines)

The Central Bank of Nigeria (CBN) regulates CP issuance to ensure market stability and investor protection. Key regulations include:

| ✔ Issuer Eligibility | Only financially stable companies with strong credit ratings can issue CPs. |

| ✔ Approval & Registration | CPs must be registered with FMDQ Securities Exchange before public issuance. |

| ✔ Monitoring & Compliance | The CBN oversees CP interest rates, maturity periods, and market trends to prevent financial risks. |

Final Thoughts

Commercial Papers are a vital part of Nigeria’s financial system, benefiting both businesses and investors. If you want to calculate potential returns on CP investments, try the Nigeria Commercial Paper Calculator for instant and accurate results. 🚀

How Does a Commercial Paper Calculator Work?

How Does a Commercial Paper Calculator Work?

A Commercial Paper Calculator is a useful tool designed to compute key financial metrics like yield, discount rate, and maturity value of a commercial paper. By using a commercial paper calculation formula, investors can estimate their returns before making investment decisions.

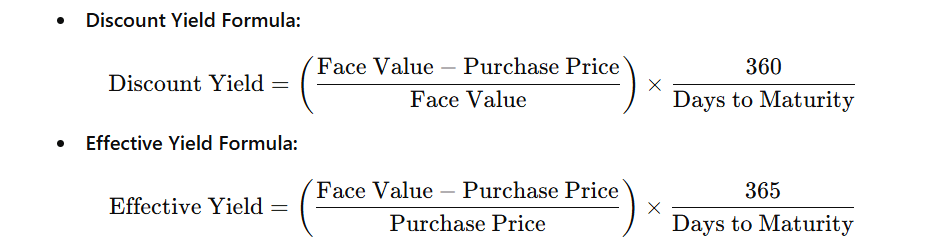

Key Formulas Used in the Calculation

1️⃣ Discount Yield Formula

The discount yield represents the annualized return based on the discount at which the commercial paper was purchased. It is calculated using the following formula:

((Face Value – Purchase Price) / Face Value) × (360 / Days to Maturity) × 100

Example: If a commercial paper has a face value of ₦1,000,000 and is purchased for ₦950,000 with 90 days to maturity:

- 📌 Discount Yield = ((1,000,000 – 950,000) / 1,000,000) × (360 / 90) × 100 = 20% per annum

2️⃣ Effective Yield Formula

The effective yield considers the actual return on investment based on the purchase price rather than the face value. It is calculated as:

((Face Value – Purchase Price) / Purchase Price) × (365 / Days to Maturity) × 100

Example: Using the same values as above:

- 📌 Effective Yield = ((1,000,000 – 950,000) / 950,000) × (365 / 90) × 100 = 21.05% per annum

3️⃣ Maturity Value Calculation

The maturity value is the amount the investor will receive at the end of the investment period.

This means that at maturity, the investor will receive the full face value of the commercial paper.

Understanding these formulas and using a Commercial Paper Calculator can help investors make informed decisions. By applying the right commercial paper calculation formula, one can accurately determine the returns and potential profitability of investing in commercial papers.

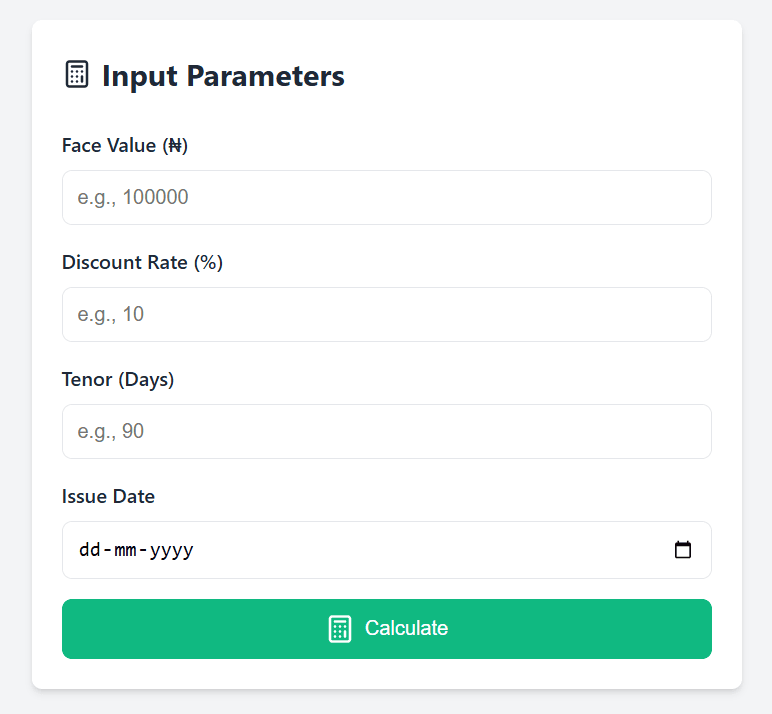

Features of a Nigeria Commercial Paper Calculator

A Nigeria Commercial Paper Calculator is an invaluable tool for both investors and businesses, simplifying the process of calculating returns and understanding the financial dynamics of commercial paper investments. Here’s a deeper look at its key features:

| Feature | Description | Example |

|---|---|---|

| Input Fields | ||

| Face Value | The total amount you will receive at maturity. It is the investment’s “end goal”. | ₦1,000,000 (This is the maturity amount you will get back.) |

| Discount Rate | The rate at which the commercial paper is sold at a discount from its face value. It determines the investor’s return. | 5% (The paper is bought at a discounted price of ₦950,000, while the face value is ₦1,000,000.) |

| Number of Days to Maturity | The period between the purchase date and the maturity date of the commercial paper. Typically ranges from 15 days to 1 year. | 180 Days (This is the time period after which the paper matures.) |

| Purchase Price | The price paid to buy the commercial paper, usually lower than the face value, due to the discount rate. | ₦950,000 (The price you pay to purchase the commercial paper.) |

| Output Values | ||

| Yield Percentage | The return earned based on the difference between the purchase price and the face value. It is expressed as a percentage. | 5% (The yield earned is calculated based on the purchase price of ₦950,000 and a face value of ₦1,000,000.) |

| Effective Interest Rate | The true rate of return on the investment, taking into account the discount rate and the period of investment. | 10.53% (The annualized effective interest rate for a 180-day period.) |

| Maturity Amount | The amount you will receive when the commercial paper matures. It is equal to the face value. The amount you will receive when the commercial paper matures. It is equal to the face value. | ₦1,000,000 (The amount you will receive at the end of the term.) |

Why Use a Commercial Paper Calculator?

Let’s say you’re considering investing in a commercial paper with a face value of ₦1,000,000, a purchase price of ₦950,000, and a maturity period of 180 days. Using the calculator:

- The Yield Percentage helps you see the return on your investment to the face value.

- The Effective Interest Rate provides a clear, annualized picture of your return, factoring in the short-term nature of the investment.

- The Maturity Amount confirms the total payout at maturity — ₦1,000,000.

This straightforward process makes the calculator a perfect tool for investors to quickly evaluate the potential profitability of a commercial paper investment and make more informed decisions. Whether you’re an individual investor or a business exploring funding options, the Commercial Paper Calculator simplifies complex calculations and provides clarity at your fingertips!

How to Use the Nigeria Commercial Paper Calculator?

The Nigeria Commercial Paper Calculator is a simple tool that helps you quickly determine the potential return on your investment. By entering details like face value, purchase price, and days to maturity, you can instantly see the yield percentage, effective interest rate, and maturity amount.

For a complete step-by-step guide and more details, click here to explore how to use the calculator and understand the calculation process better.

Conclusion

Commercial papers are essential for Nigeria’s economy, providing businesses with short-term funding and investors with competitive returns. The Nigeria Commercial Paper Calculator is a valuable tool that simplifies complex investment calculations.

By offering key metrics such as yield, effective interest rate, and maturity value, it enables investors to make informed decisions about their investments.

Whether you’re new to investing or a seasoned pro, this tool helps optimize your commercial paper strategy. Try it today and take control of your investments!

The concept is well explained, but adding a section on the advantages of using this calculator compared to manual calculations could make it more informative.

Can you share with me the calculator link?

Here is the link to the Nigeria Commercial Paper Calculator.

Great topic choice! You might consider including a brief overview of Nigeria’s commercial paper market to give readers more context before introducing the calculator.

The concept is well explained, but adding a section on the advantages of using this calculator compared to manual calculations could make it more informative.